What Is A NFT — Understanding The Primary Concepts

A gentle introduction to the primary NFT concepts with diagrams

The recent hype in Non-Fungible Tokes (NFT) resulted in some new concepts in the area of Blockchain and Web 3.0, mainly in the introduction of selling points for trading digital works of art and design.

Paper-based collectibles from another era: Photo by

Pascal Brokmeier on

Unsplash

Introduction

So what does Non-fungible mean exactly in the space of cryptocurrencies and tokens?

“Non-fungible” more or less means that it’s unique and can’t be replaced with something else. For example, a bitcoin is fungible — trade one for another bitcoin, and you’ll have exactly the same thing. A one-of-a-kind trading card, however, is non-fungible. If you traded it for a different card, you’d have something completely different.(Verge)

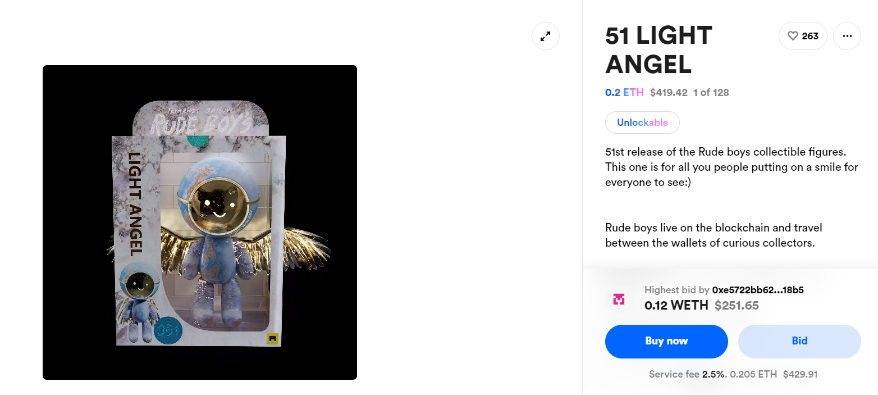

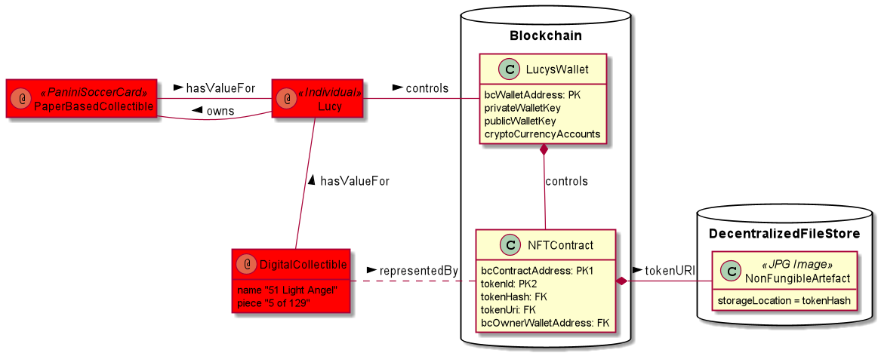

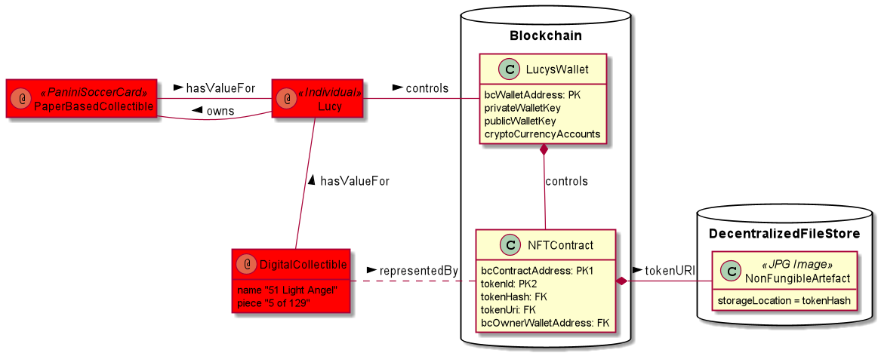

As an example below, you see a digital collectible figure which exists in the virtual world of a blockchain as a non-fungible token.

As with real-life tangible collectibles, there is a certain amount — in the example below 128 - of collectibles of this type (“51 Light Angel”) available for sale.

NFT backed digital collectible figure (

Rarible Store)

As with the ancient Panini soccer cards, virtual collectibles represent a certain value for their owners, and they are willing to invest some money to be the owner of it.

The actual value of a collectible is derived from its scarcity and demand by other collectors.

Source:

Link

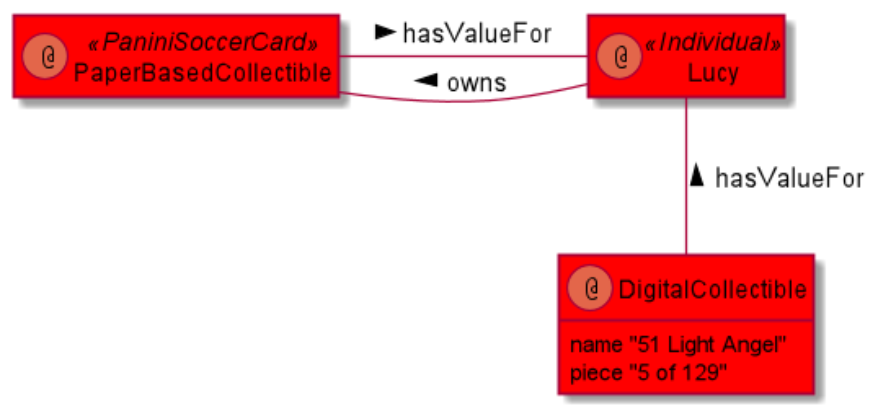

So from this point of view, there is nothing special about a digital collectible. Both collectibles have value for Lucy and Lucy wants to possess them.

For the paper-based collectibles, the card’s ownership is clearly defined; you are physically in possession of the collectible. It’s tangible.

NFT and ownership — really?

How does ownership look for the NFT which lives on a Blockchain? First of all, you rather have to use the term “control ship” than “ownership.” As explained by Errata Security in his

article.

We keep talking about “ownership” of NFTs, but this is fiction. Instead, all that you get when you acquire an NFT is “control” — control of just the token even, and not of the underlying artwork. Much of what happens in blockchain/cryptocurrencies isn’t covered by the law. Therefore, you can’t really “own” tokens. But you certainly control them

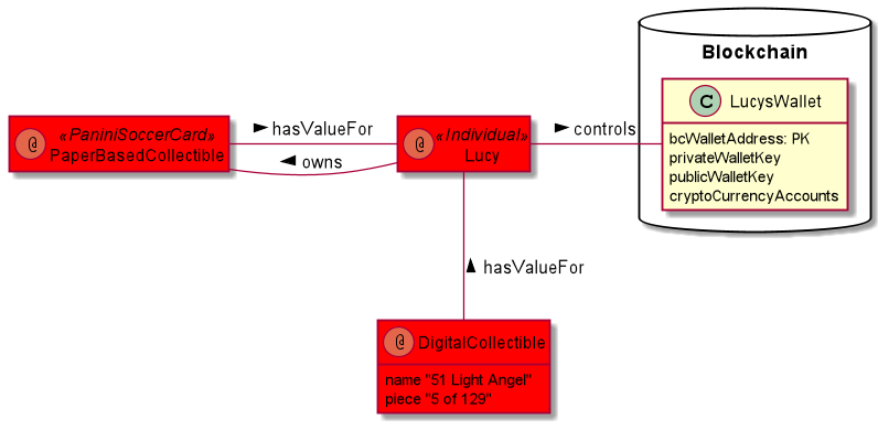

So let’s look at how we can control an NFT.

First of all, you require a wallet that you control and serves as a store of value of cryptocurrencies and tokens.

A unique blockchain address represents a wallet (bcWalletAddress) which is your primary key (PK). With your private key (privateWalletKey) in your wallet that matches the public key ( publicWalletKey) of your address, you control the address and any transaction executed with this address. Obviously, you have to protect your private key. It’s the secret that gives you control ship over the blockchain address. Any person in possession of your private address may drain your wallet. During the creation of a new wallet, you will get to know the private/public key and set a password for your wallet. Keep the private key and password secure.

Having a wallet, you now may purchase an NFT, for example, our digital collectible.

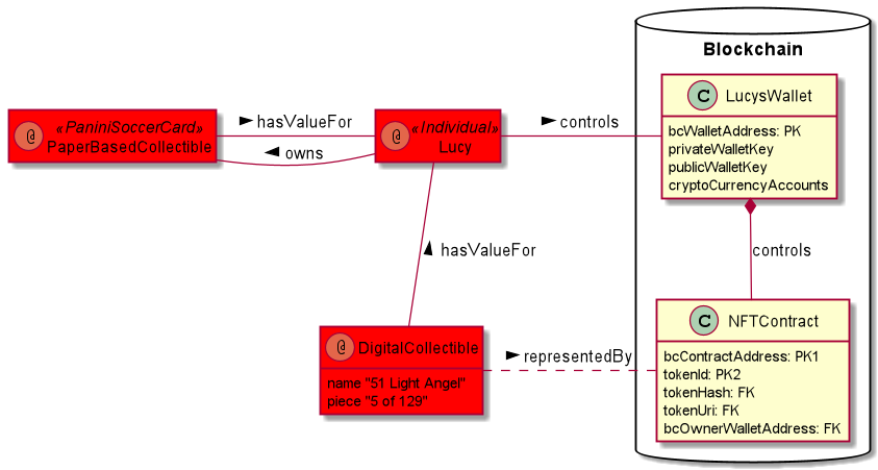

The NFT is represented by a blockchain contract NFTContractwith its unique address (bcContractAddress = PK1) complemented with the unique token identifier of your non-fungible collectible item (tokenId = PK2). By associating this unique token of the contract (PK1+PK2) with your wallet address (bcOwnerWalletAddress) you will get the required control over the collectible. Any transaction with this specific token will require the knowledge of your wallet’s private key, which you only know.

NFT Shopping Concept

Mapped to the real world, an NFT Contract type represents a store, which offers various items for sale, represented by a specific token.

Photo by

Artem Gavrysh on

Unsplash

But here, the analogy stops. In the digital world, you would enter the shop, agree on the price for an item with the shop owner and then put it immediately into a locker which you close with your private wallet key.

Photo by

Elizabeth Kay on

Unsplash

Because the locker lives on a decentralized blockchain, your NFT will be available for you even the shop goes out of business, the locker stays. We will come back to that latter, but it’s key to understand that an NFT with all its definition around the backed digital artifact

should have no ties to its shop, where it got sold! A shop may be gone in some years, but the blockchain (Ethereum) is decentralized and may work forever (ok, that can be debated as well…).

There is one missing piece: How is our collectible represented in our locker?

What would you find in the locker itself when opening it? Well, I would expect an image or a video of the digital collectible for which I could prove that I’m the controller of it.

For that, we introduce an additional concept, the decentralized file store.

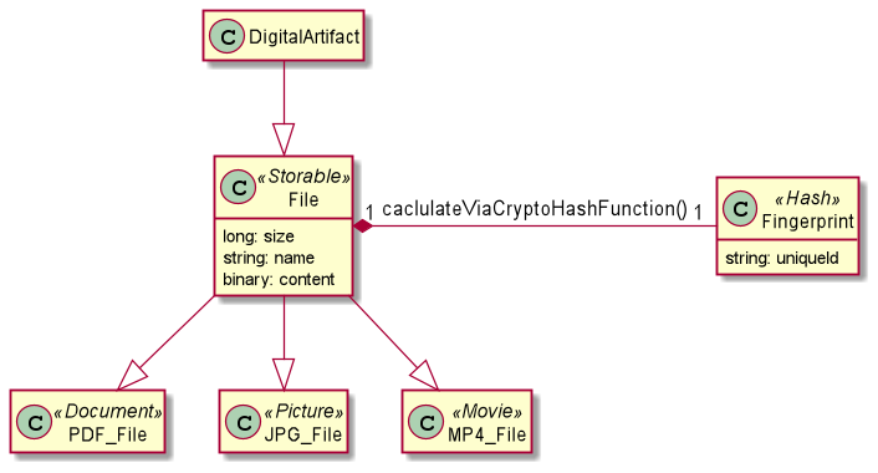

Where is your digital artifact?

A digital artifact will represent your digital collectible, be it an image, movie, pdf, or other formats. This artifact may be of any size, from some kilobytes to megabytes. To store them in the blockchain — which would be technically possible — would be way too expensive. Therefore a so-called “off-chain” solution is considered: the decentralized filestore.

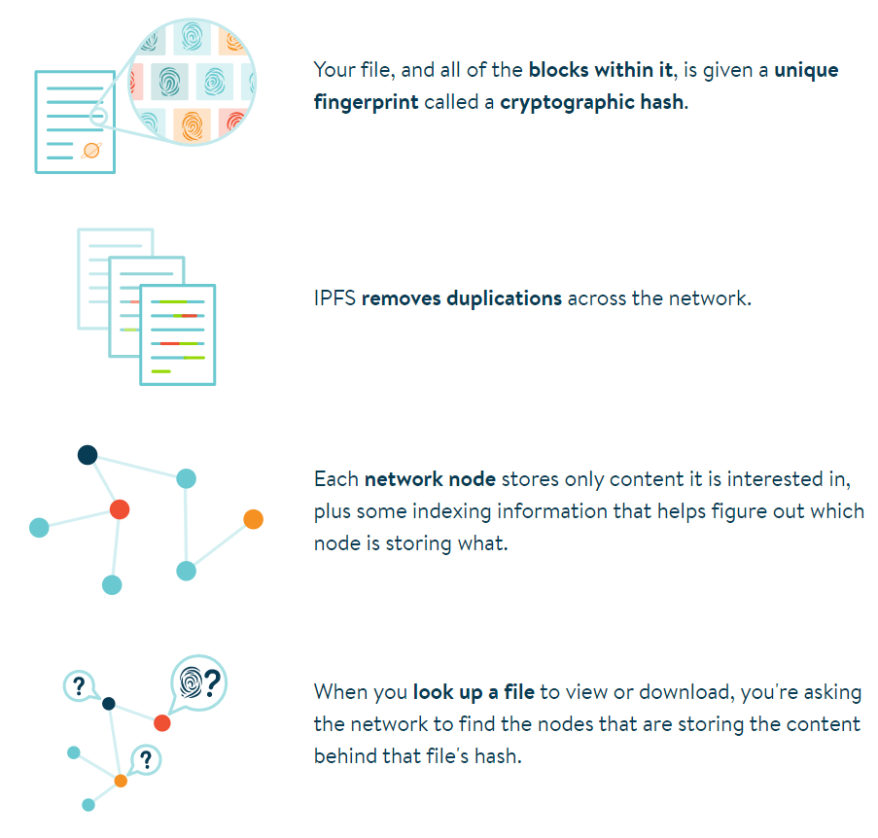

As with the decentralized blockchain (which isn’t controlled by an entity), the decentralized file-store has the same attribute in the control ship’s context. It doesn’t belong to anybody. The most famous one is the I

nterplanetary File System (IPFS). When you upload a file to IPFS, the following happens:

So the cryptographic concept of a “hash” or “fingerprint” plays a key role:

A “hash” passes all the bytes of a file through an algorithm to generate a short

signature

or

fingerprint

unique to that file. No two files with different contents can have the same hash. The most popular algorithm is

SHA-256

, which produces a 256-bit hash.

We call it a

cryptographic hash

to differentiate it from weaker algorithms. With a strong algorithm, it’s essentially impossible for a hacker to create a different file that has the same hash — even if the hacker tried really hard. (Link)

Having the hash stored for a file as part of the token contract allows identifying a uniquely a file, representing a digital collectible, art, or document.

You can download any file from the decentralized file store to your personal computer, i.e., as well as Beeple’s 69-million worth image “Everyday’s: The First 5000 Days” and when you calculate the hash for the file it would always generate the same unique id, which is sealed in a token contract and transferred by Beeple to the person’s wallet who paid this unbelievable amount for this piece of art. If you are interested in this transaction’s details, refer to the Errata Security blog article “

Deconstructing that 69 million NFT”.

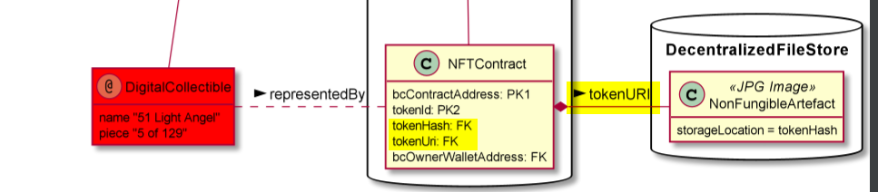

This is represented in our diagram above as follows:

Our NFT contract requires two additional attributes, tokenHash as well as tokenURI

The first attribute stores the hash of the digital collectible file which you purchased. That means you could download the file to your local drive, store it on a memory stick, and put it into a physical locker (cold store).

At any time (i.e., 10 years later), you could take it out of the locker and calculate the hash on your computer, producing the exact unique id found in the corresponding NFT contract.

The second attribute is a unique string of characters used to identify a resource on a computer network, of which the best-known type is the web address or URL.

I.e., it would point to the actual file on the internet. Using a decentralized file store as IPFS, it could like the following.

The long number at the end of the URI would be the actual hash of the file. Remember, each file has a unique hash, and therefore, even doing multiple uploads of the identical file will result in one copy (which is distributed among the various IPFS nodes).

There you are!

Finally, we have found Lucie’s purchased digital collectible, at the end an ordinary file stored in the space of the Internet. That’s it.

Now, where does the value come from now, considering that anybody can download that specific file?

I think the following statements made by Mark Cuban in various blogs are to the point. He talks about cryptocurrencies, shares, and gold; actually, it holds for NFT as well. All of them are representing a store of value (refer to my article “

When money left the tangible asset space” for getting an overview of basic concepts around digital money and its features)

The intrinsic value of anything — a Bitcoin, an ounce of gold, or a share of GameStop — is simply what people believe it is. Nothing else matters, Mark Cuban argues in a recent blog post.

That concept is the secret to understanding Bitcoin, stamp collecting, and the recent GameStop craze, he says. Understand this and it can help make you rich. Fail to understand it and, like the short sellers who bet against GameStop, you could lose everything. (Link)

An NFT gets valuable as soon as people believe that controlling a file on the internet represents some value. The value relies upon the fact that a person (i.e., artist, graphic designer) uploaded his digital artwork (btw. there is no proof of authenticity here, the purchaser has to trust the narrative around the uploaded digital artifact and its authenticity) and minted an NFT token which seals the hash of the file.

Rather fuzzy the whole thing, how value gets created. But that’s ok, according to Marc Cuban.

“What is a store of value? It’s something that some number of people assign value to and are willing to pay for and then hold on to, hoping that circumstances increase the value of that item,”

And finally concludes:

There’s a lesson here for your own business and investments, and for the products your company sells. Don’t be fooled into thinking that the price of any item is based on anything other than the narrative around it and what people believe about it … good or bad, up or down, it all comes down to the narrative, to which story people most believe. Find a way to control the narrative, and you can pretty much control the world.

A provocative statement of how digital markets function, but nicely matches the classical art market as well, in my opinion.

With this food for thought, I conclude this gentle introduction to NFT with a word of caution:

Do your NFT due diligence before spending money on it

When you intend to purchase an NFT collectible or artwork, make sure to do some due diligence in the context of

-

What is stored in the NFT contract itself, which proves that you control the digital artifact stored? The NFT contract should have enough information stored that you can derive the exact location of the off-chain stored file. You shouldn’t require any additional information provided by the seller website or DEFI app (which could be out of business after 1, 5, or 10 years).

-

The same holds for the file location (i.e., URI). Ensure that the file is located on a decentralized file store and not only stored, i.e., on a Webstore of a specific company. Even if the NFT contract seems accurate, the actual file could disappear from the internet when the company goes out of business. You can and should mitigate that risk and download your purchased artifact. Remember you can create at any time the unique hash of this file, which resides in the NFT contract (without requiring any third-party systems on the Internet)

-

Memorize the below diagram with its concepts and associations (obviously there are variations in the implementations) and check out the excellent article by Errata Security which gives some good and bad examples of NFT contract implementations.

comments powered by Disqus