The Conclusion Of The Long-Term Debt Cycle And The Rise Of Bitcoin

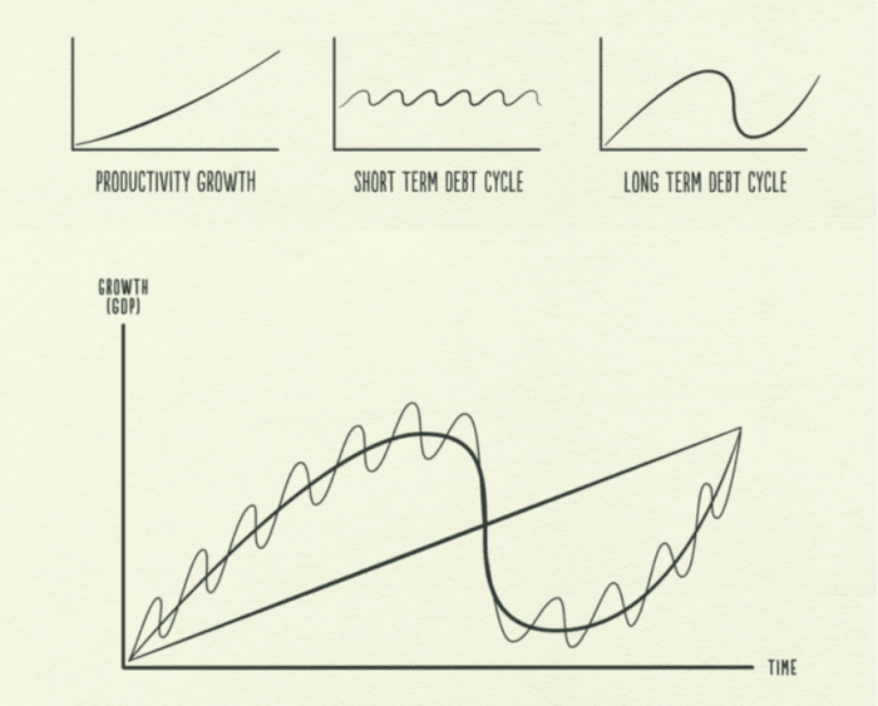

One of the best introductions to the macro-economic principles and their underlying deb cycles is a Youtube video by Ray Dalio (Principles for Navigating Big Debt Cycles), which I mentioned in the following

blog article.

The Bitcoin Magazine recently published an article, “

The Conclusion of the Long-Term Debt Cycle and the Rise Of Bitcoin,” by Dylan Leclair, which builds on Ray’s article is applying his principles and framework to the new world of digital currencies.

The primary statement is that the incumbent global financial system is irreversibly broken. His article will outline how the world got to this point and what the world will look like coming out of the present crisis.

The article is definitely worth a read and describes how we reached the end stage of a debt supercycle.

“The majority of the increase in asset prices has not been the result of increased productivity or output, but rather the result of massive credit expansion.”

What results in a risk-free investment system

“With the Federal Reserve pegging interest rates at zero, along with conducting massive QE programs to monetize federal deficits, the underlying “risk-free rates” of the financial system actually promise return-free risk.”

In the last decades, technology fundamentally changed the rules of our economic system. These new rules must be absorbed and adjusted by the underlying monetary system, which it can’t. As the article states:

“We live in a world where rapidly improving and advancing technology continues to give us

more for less

. As jobs of the past are automated away, and technology continues to

drive the costs of many aspects of life to near zero

, our

monetary system necessitates

that everything continues to

increase in cost in nominal terms in perpetuity

. Even though technological advances should be giving everyone the gift of a higher standard of living for less real cost, the

incumbent monetary system must avoid deflation at all costs

.

In a world that is experiencing exponential technological growth, exponentially more stimulus and debt are needed to keep the system glued together.”

A fascinating point, which results in the finding, that we only can escape this death cycle by switching our monetary system to a seizure- and censorship-resistant asset

“Now, with the emergence of bitcoin, there is a seizure- and censorship-resistant asset that is outside the domain of any one jurisdiction. With Bitcoin, it is possible to store wealth in a self-sovereign way with absolutely zero counterparties or credit risk.”

Definitely worth a read. A lot of helpful diagrams back to the article. Make your own opinion, if it is bitcoin or any other digital currency which breaks this death cycle … or are we just entering new fiat money-backed long-term debt cycle?

comments powered by Disqus