The Diagrammer Series – When Money Left The Tangible Asset Space

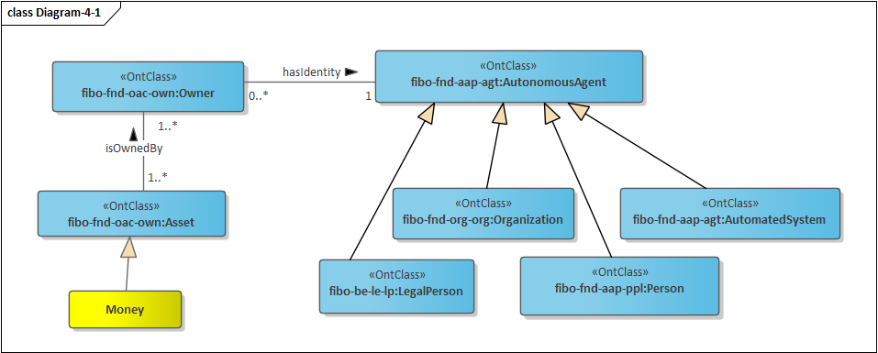

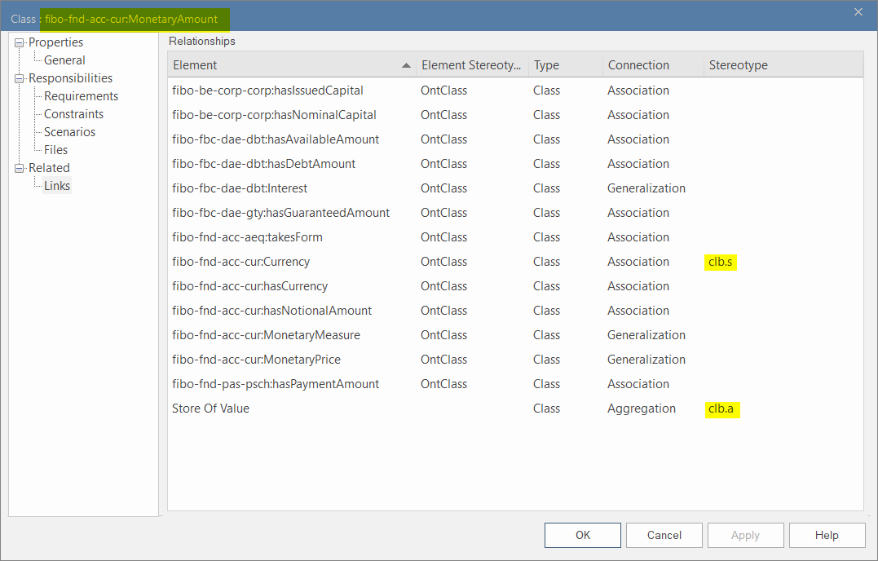

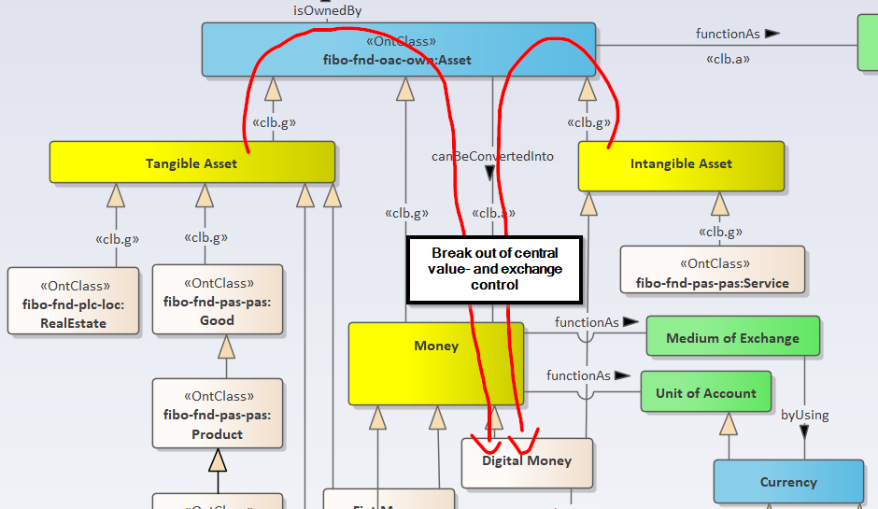

In the last article, we established the Asset concept model in the context of FIBO (blue classes below). Today we concentrate our work around the main asset type, the Money concept. Money plays a central role in our society and is as well a main driver for the Decentralized Finance (DeFi) concept space.

Although the people in history might have lived through the exchange of goods and not relying on the value of money itself, modern society today could not function without money. Money plays a huge role in society in a variety of ways, such as in business, at people’s jobs, and even in education. Money helps people achieve a better quality of education, a larger chance of business success, and higher work output.

[12]

For that, we leave the FIBO ontology model behind us. The concept of Money isn’t defined in a way that is suitable for our conceptual DeFi work. It’s focus relies on the classic concept of Money as a tangible asset of value exchange issued by a central authority as used by financial services. We definitely have to enhance that. So let’s start then.

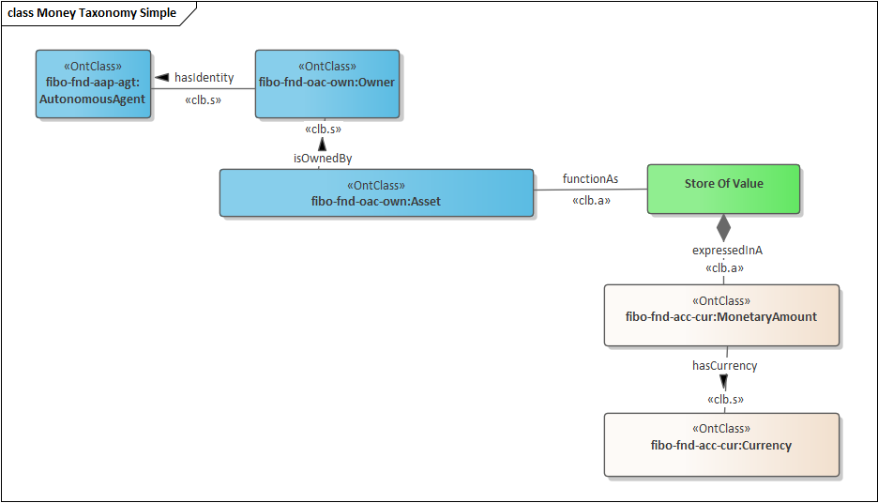

Store of Value Concept

Let’s revisit the Asset concept quickly. The main property of an Asset is that it functions as a

Store Of Value

, which is defined as:

A

Store Of Value

is the function of an asset that can be saved, retrieved, and exchanged at a later time, and be predictably useful when retrieved. More generally, a store of value is anything that retains purchasing power into the future.

[13]

The value of an asset may be expressed in a

Monetary Amount,

which is based on a

Currency

.

Monetary value is the amount of currency that would be exchanged for the sale of an asset. It is commonly understood as the worth in cash that something has within the open market.

Let’s check out the FIBO definition of Currency:

Is a Medium of Exchange value, defined by reference to the geographical location of the monetary authorities responsible for it

The FIBO currency definition is strongly linked to monetary authorities' control in geographical or jurisdictional locations. As we see shortly, that is not generic enough to be used for a concept model in the decentralized finance world.

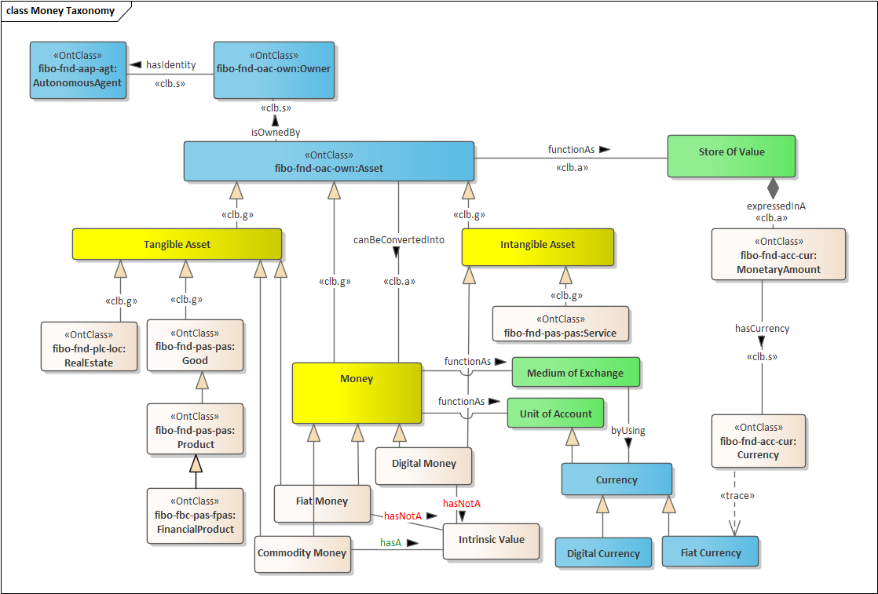

Stereotypes

Before we move on let’s explain the meaning of some Stereotypes which we introduced in the above UML diagram, i.e <<clb.s>>, <<clb.a>>.

A stereotype is one of three types of extensibility mechanisms in the Unified Modeling Language (UML), the other two being tags and constraints. They allow designers to extend the vocabulary of UML to create new model elements, derived from existing ones, but that have specific properties that are suitable for a particular domain or otherwise specialized usage.

[13]

In our case, we introduced the stereotypes for the UML Modeling element “Association.”

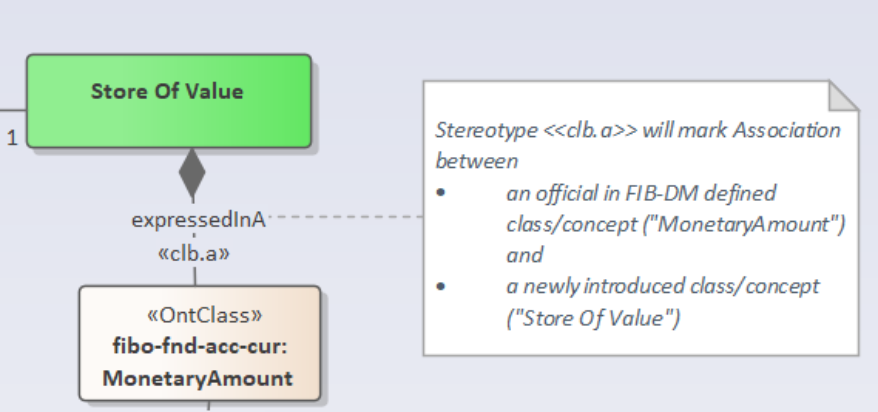

The <<clb.a>> “append” stereotype allows us to identify Associations between FIB-DM model elements and newly introduced one by us.

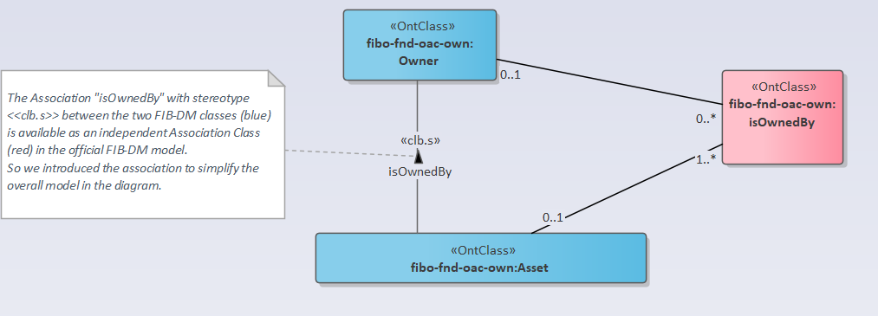

The <<clb.s>> “simplify” stereotype allows us to identify direct Associations between two FIB-DM classes, which are modeled out in the FIB-DM as well as Association classes.

By introducing these two extension mechanisms (stereotypes), we can at any time identify in a standardized way where we introduced new concepts or simplified the FIB-DM model.

You will also encounter the <<clb.g>> stereotype in diagrams, which marks Generalization association between FIB-DM concepts and newly introduced ones.

Refer to the below screenshot, which shows all linked elements for the class “MonetaryAmount.” With a glimpse of a view, you can easily identify how the concept was enhanced with new relationships.

Enough of theory, let’s switch back to our concept modeling.

Money Concept

Money plays a pivotal role and is defined as:

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context.

[13]

So let’s enhance our diagram with various concepts to embed the Money concept world firmly.

As one can see in the above diagram:

-

For Asset, we introduced three distinct subtypes, beside Money as well as Tangible Asset and Intangible Asset subtype (yellow concepts)

We define the two new asset types (used mainly in the accounting area) as:

A

Tangible Asset

is any physical asset owned by an autonomous agent to produce or purchase goods and services. They have a finite monetary value and can be quantified with relative ease. Tangible assets can also be sold to generate a monetary amount in the event the autonomous faces financial difficulty. Examples like property, plant, equipment, but also securities (like stocks, bonds, cash) are treated as a tangible asset.

As well as

An

Intangible Asset

is an identifiable non-monetary asset without physical substance. Such an asset is identifiable when it is separable, or when it arises from contractual or other legal rights. Separable assets can be sold, transferred, licensed, etc. Examples of intangible assets include computer software, licenses, trademarks, patents, films, copyrights, and import quotas. [14]

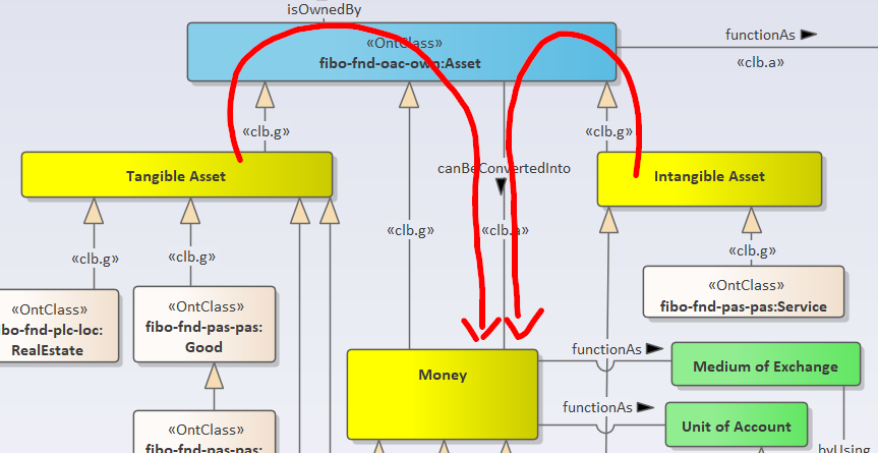

We explicitly decided to keep Money separate of the Tangible- and Intangible Asset types because, since the introduction of Digital Money, the Money concept left the Tangible Asset Space and can now be either a tangible or intangible asset.

To understand that better let’s check the subtypes of the Money Concept and their properties

-

Commodity Money and Fiat Money are representations of tangible assets

-

Digital Money is a representation of intangible assets

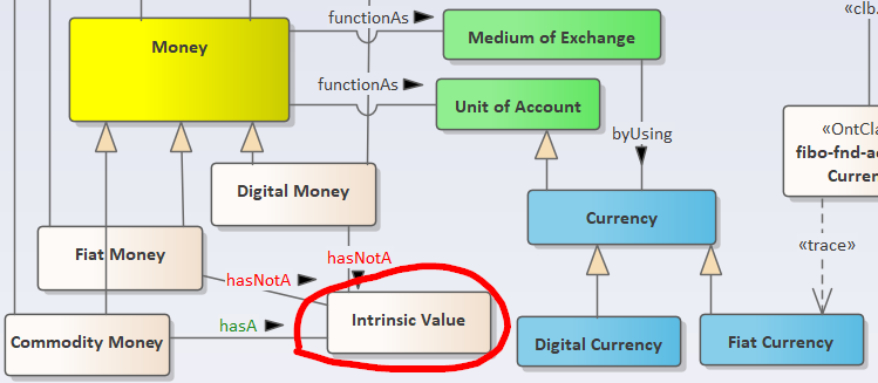

Commodity Money

Is defined as

Commodity Money

is money whose value comes from a commodity of which it is made. Commodity money consists of objects having value or use in themselves (intrinsic value) as well as their value in buying goods.

Picture by

Wikipedia

It’s a money type which is based normally on a Thing, which has the feature of Scarcity.

As we see later,

Scarcity

is one of the key design features of a digital currency as well and refers to the basic economic problem

the gap between limited – that is, scarce – resources and theoretically limitless wants. This situation requires people to make decisions about how to allocate resources efficiently, to satisfy basic needs, and as many additional wants as possible. Any resource that has a non-zero cost to consume is scarce to some degree, but what matters in practice is relative scarcity.

[15]

Commodity Money based on a scarce (not easy to get) resource –for example Gold – is a Store of Value, as well has intrinsic value features like

-

composability

-

easily and securely storable

-

transportable

-

difficulty to counterfeit

which makes it an ideal

Medium of Exchange

, a second major function of Money.

A

Medium of Exchange

is an intermediary instrument or system used to facilitate the sale, purchase, or trade of goods between parties. For a system to function as a medium of exchange, it must represent a standard of value. Further, all parties must accept that standard.

[15]

The third major function of many is its representation of a standard of value, which is also described as a

Unit Of Account

. The value of something is measured in a specific

Currency

, which allows different things to be compared against each other.

The above diagram shows all the three main functions of Money as green concepts.

The model expresses with the Association “canBeConvertedInto” the power of Money acting as Medium of Exchange (payment) to convert the Store of Value of any Asset into Money.

When we talk about Fiat Money, we normally refer to it’s unit of account function as Fiat Currency.

Fiat currencies expressed in nations coins and bank notes are playing a major ( perhaps the most important) role in the world of value exchange.

Fiat Money

is defined as

Fiat money is a government-issued currency that is not backed by a physical commodity, such as gold or silver, but rather by the government that issued it. The value of fiat money is derived from the relationship between supply and demand and the stability of the issuing government, rather than the worth of a commodity backing it as is the case for commodity money. Most modern paper currencies are fiat currencies, including the U.S. dollar, the euro, and other major global currencies.

[15]

As the definition above states, a Fiat Money has no intrinsic value, which holds true also for Digital Money, as we see later in the article.

Its value is purely derived by the

-

relationship between supply and demand, but as well as

-

the stability of the issuing government.

To believe in the value of a Fiat currency, you have trust in the issuing government, which ultimately controls the value of the Fiat currency.

Despite the use of fiat money (money that is not backed by a commodity but is backed by the government), many don’t really believe it has any worth at all. After all, the government can control what the currency is worth by issuing more or less of it. The banks also have a say in how money travels from one person to the next. [16]

These shortcomings - in the context of centralized controls in the value setting, as well as value exchange – resulted in the nineties of the last century in the rise of Digital Currencies, namely Crypto Currencies.

For these reasons, some have begun to lose faith in these more “tangible” financial assets. To solve this, the belief arose that re-establishing the value of tangibles would have to be done through intangibles mediums. Namely cryptocurrencies. This is because we currently believe that money has value, and so it does. If we all agree that crypto has value, then this currency would be used for a wider range of uses.

[16]

Finally, we arrived by one of our main concepts in the world of Decentralized Finance (DeFi), the Digital Money, a new type that lives in the Intangible Asset space and may circumvent the shortcomings of Fiat currencies which are controlled by governments and financial institutions. Digital Money is defined as

Any means of payment that exists purely in electronic form. Digital money is not tangible, like a dollar bill or a coin. It is accounted for and transferred using computers. The most successful and widely-used form of digital money is the cryptocurrency Bitcoin. Digital money is exchanged using technologies such as smartphones, credit cards, and online cryptocurrency exchanges. In some cases, it can be transferred into physical cash, for example, by withdrawing cash from an ATM.

[15]

We are now ready to enter the digital space with it’s decentralized and permissionless innovative blockchain solutions.

In the next article, we do an additional refinement step in the digital money taxonomy by introducing the “money flower concept,” as introduced by the Bank Of International Settlement. Stay tuned!

References

|

[12]

|

“Money’s Role In Society,” [Online]. Available: http://scripts.cac.psu.edu/users/h/w/hwp5131/Assignment%205.html.

|

|

[13]

|

“Wikipedia,” [Online]. Available: https://en.wikipedia.org/.

|

|

[14]

|

“IFRS Reporting Standard,” IFRS, [Online]. Available: https://www.ifrs.org/issued-standards/list-of-standards/ias-38-intangible-assets/#about.

|

|

[15]

|

“Investopedia,” [Online]. Available: https://www.investopedia.com/.

|

|

[16]

|

S. Kordyban, “hedgetrade.com,” 19 December 2019. [Online]. Available: https://hedgetrade.com/is-crypto-an-intangible-asset/.

|

comments powered by Disqus